U.S. Economy Loses Its Bounce as Recovery Turns Into a Grind

Another from sonofseawolf, it looks like the US economy isn't holding out so well:

Just a few months ago, the U.S. economy looked like it was

roaring back from the pandemic slump. Now the recovery is starting to look more

like a grind.

The spread of the delta variant has held back millions of

Americans from spending on services like restaurants and hotel rooms.

Supply chains are still creaking and Hurricane Ida, which

caused havoc in petrochemicals hub Louisiana as well as roughly $20 billion of

flooding damage in the Northeast, may have made them worse. And high inflation

is stretching household budgets.

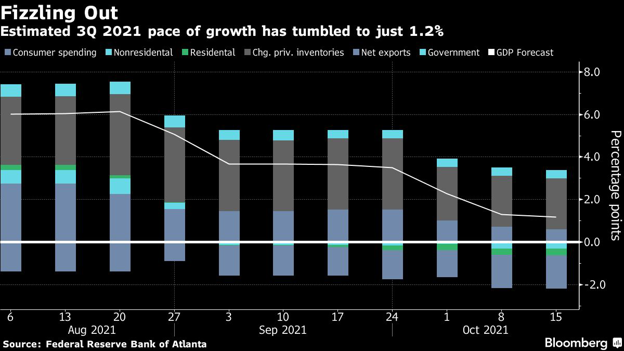

The Atlanta Federal Reserve’s real-time estimate of economic

activity now predicts growth of 1.2% in the quarter that ended in September.

Two months ago it was forecasting 6%.

Estimated 3Q 2021 pace of growth has tumbled to just 1.2%©

Bloomberg Estimated 3Q 2021 pace of growth has tumbled to just 1.2%

Economists surveyed by Bloomberg are more upbeat. Still, the

consensus growth forecast for the third quarter has dropped sharply since

August.

None of this means the U.S. rebound is heading into reverse,

says Nathan Sheets, newly appointed chief economist for Citigroup Inc. “I think

recession’s too strong,” he says. “But it’s certainly softer.”

Here are five indicators that illustrate and explain the

gathering gloom.

Delivery Delays

Many forecasters use the Purchasing Managers’ Index –- based

on a survey of supply-chain managers -- to gauge the state of manufacturing,

which feeds into their growth estimates. One of its five components is supplier

delivery times, and longer waits are typically seen as a sign of robust demand

and a strong economy.

Long Delays

But in pandemic conditions, that may not tell the whole

story. There have been unprecedented problems with shipping goods to the U.S.,

and transporting them once they’re here. In other words, the long waits may be

as much a sign of supply weakness as strength in demand –- and confusing those

two things may have led economists to be too optimistic about growth.

Missing Jobs

Economy watchers have also been flummoxed by the labor

market. There are more than 10 million open positions – but the pace at which

they’re being filled has slowed sharply. In the past two months, virtually

every economist surveyed by Bloomberg over-estimated the number of new jobs.

In the Clouds

The lowest-paid Americans are bearing the brunt of the

slowdown. Among workers in the lowest quartile of earners, employment was down

by 25.6% compared with pre-Covid levels as of mid-August, according to

Harvard’s Opportunity Insights project. That’s the worst number since June

2020, a few months after the pandemic started.

Inflation Bites

Inflation is throwing a wrench into the recovery too. The

debate over whether pandemic price surges are transitory has yet to be settled

– but they’re reaching ever-deeper into the economy, and crimping the spending

power of households. Mark Zandi of Moody’s Analytics estimates the typical

household has to pay $175 a month extra.

Energy and commodity costs are spiraling higher. Buying

conditions for homes, vehicles and durable goods all deteriorated in August due

to high prices, according to the University of Michigan’s latest consumer

report. Auto purchases fell from an 18.5 million annual pace in April to just

12.2 million last month.

The first wave of pandemic inflation was confined to a

relatively small group of goods and services. That’s no longer the case,

according to the Cleveland Fed.

Price Shifts

Its researchers found that in recent months, roughly

three-quarters of the 44 main components of price baskets were growing at a

pace above 3%. That compares with less than one-third of them at the start of

this year.

Services Lag

The pandemic upended American spending habits. Households

are buying more goods than ever before -- a splurge that’s contributing to the

strains on supply chains. But economists say a balanced recovery will require

more spending on services too, and that’s happening more slowly.

Persistent Gap

Restaurants are one example. The spread of delta in the

summer months halted the revival of dining out, which has settled at levels

below what was normal before Covid hit.

Gloom Feeds Gloom

Business leaders and the general public are turning downbeat

about the economy –- and those expectations can be self-fulfilling, if they

mean that companies invest less and households are more cautious about

spending.

Sentiment Fades

The Michigan consumer survey found that only 44% of

Americans expect their financial situation to improve, the lowest reading in

seven years.

Sentiment among small-business owners deteriorated in

September, with the number who expect better business conditions over the next

six months falling to the lowest since December 2012. A CEO confidence measure

compiled by Chief Executive magazine has also declined for three straight

months –- to a level that means all of the gains earlier in 2021 are now gone.

(Update with latest Atlanta Fed data)

Comments

Post a Comment